Note: This guest post is by Frederick “Beau” Kron, an Independent Adjuster, Trainer, Appraiser & Umpire. He has written this post as an Independent Adjuster and not on behalf of the IAUA. Opinions expressed are solely his own and are not meant to express the views or opinions of the IAUA.

This year, a record-tying three hurricanes—Debby, Helene, and Milton—have made landfall in Florida. According to meteorologist Phil Klotzbach, this has only happened five other times in over 150 years, most recently in 2005. Previous occurrences were in 2004, 1964, 1886, and 1871. No season on record has seen more than three hurricanes make landfall in Florida.

For those of us in the industry back in 2004, you might remember grouping Hurricane Ivan with “The 4 of ’04.” Even though it impacted Florida, Ivan technically made landfall in Alabama, just west of the Alabama-Florida border.

In the wake of Hurricane Milton’s recent impact on Florida, a crucial question has emerged for property owners: When a tornado occurs during a hurricane but beyond the boundaries of hurricane-force winds, which insurance deductible applies?

The Milton Effect: A Tornado Outbreak

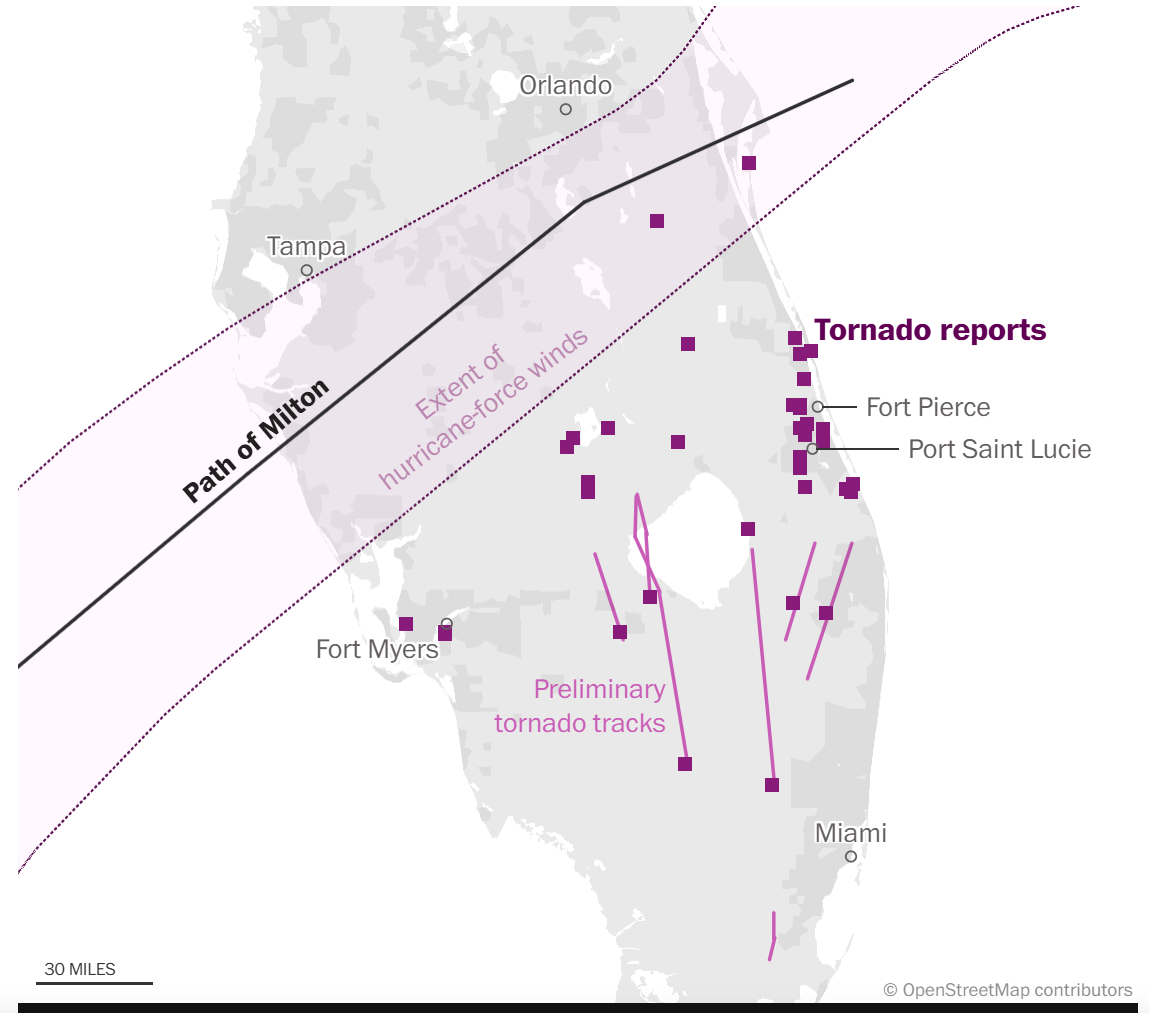

The National Oceanic and Atmospheric Administration Storm Prediction Center reported 38 preliminary eyewitness accounts of tornadoes during Hurricane Milton – a staggering number considering Florida’s average of 50 tornadoes in an entire year.

This deductible issue is particularly relevant for Palm Beach Gardens, an area that, despite being well outside of the hurricane-force wind path, experienced significant tornado damage — including an industrial dumpster landing on a residential roof.

The questions swirling around which deductible should be applied highlight the importance of understanding your policy’s definitions.

Hurricane Deductible Confusion

Most homeowners policies include a hurricane deductible, typically higher than the standard wind or All Other Peril deductible. But when does this hurricane deductible come into play, especially in cases of tornado damage far away from the hurricane-force winds?

Let’s examine a sample AAA HO3 policy (FL 1000 1007) to shed light on this issue. This policy has a Hurricane Deductible:

SECTION 1 – HOMEOWNERS COVERAGES

PART I – PROPERTY COVERAGES

***

CONDITIONS – PART I

***

- Hurricane Deductible

***

The hurricane deductible stated on the declarations page applies for loss or damage to covered property caused by all hurricane windstorms. A hurricane percentage deductible is determined by applying the percentage stated on the declarations page for hurricane to the COVERAGE A – DWELLING limit of liability at the time of the loss, but shall not be less than $500.

Deciphering Policy Definitions

The key to understanding whether this deductible applies is in the policy DEFINITIONS section, where terms in bold within the policy are explicitly defined. In this AAA policy, we find:

DEFINITIONS

***

Hurricane – means a storm system that has been declared to be a hurricane by the National Hurricane Center of the National Weather Service. The duration of the hurricane includes the time period, in Florida:

a. beginning at the time a hurricane watch or hurricane warning is issued for any part of Florida by the National Hurricane Center of the National Weather Service;

b. continuing for the time period during which the hurricane conditions exist anywhere in Florida; and

c. ending 72 hours following the termination of the last hurricane watch or hurricane warning issued for any part of Florida by the National Hurricane Center of the National Weather Service.

***

Hurricane windstorm – means wind, wind gusts, hail, rain, tornadoes, or cyclones caused by or resulting from a hurricane which results in direct physical loss or damage to property.

*emphasis added

The Conclusion

Based on the definitions in this particular policy, it is specifically stated that tornadoes occurring during a hurricane are considered part of the “hurricane windstorm.” This means that even if a tornado causes damage in an area with otherwise mild winds during the hurricane, the hurricane deductible would still apply. Your policy might be different.

Almost ten years ago, in Storm-Induced Tornado Damage, the Merlin Law Blog discussed a similar case where the lower courts deemed the State Farm policy language to be ambiguous. Even though the appeals court ultimately sided with the insurance company, the language in many policies has since been expanded for clarification, as in this AAA policy.

Key Takeaways for Property Owners

- Review Your Policy: Carefully read your insurance policy, paying close attention to definitions and deductible clauses.

- Understand the Definitions: Pay attention to how your policy defines terms like “hurricane,” “hurricane deductible,” “hurricane loss,” and “hurricane windstorm.” These definitions can significantly impact which deductible applies.

- Document Damages: In the event of a loss, thoroughly document all damages, regardless of whether they seem hurricane or tornado-related. Damages caused by tornadoes are not always obvious and can be subtle but significant.

As we navigate the complexities of severe weather events, understanding your insurance policy becomes increasingly crucial. Stay informed with resources like Twelve Tips for Making a Claim for Tornado Damage to Your Property on Your Homeowner’s Insurance Policy, but don’t hesitate to seek clarification on your coverage from a professional.

Disclaimer: This blog post is for informational purposes only and should not be considered legal advice. Always consult with a licensed insurance professional or attorney for guidance on your specific situation.