A century from now, business historians will still be studying how Tesla recreated the automotive and transportation industry. The lessons they learn will be the same that can drive insurance technology decisions today.

For starters, Tesla conquered the twin issues of retrofitting and incremental innovation by starting with completely new assumptions.

Released from many of the traditional manufacturing constraints inherent with combustion engines, fuel systems, and many more parts, the level of entry was lowered, and the level of creativity could be raised. An entirely new business model became apparent. It didn’t take an auto manufacturer to make an auto. It took a well-built business model to create a well-built consumer product. So, Telsa went about creating a better, simpler manufacturing, purchasing, driving, and owning experience.

Insurance technology, like automotive technology, has been subject to much retrofitting. Out of necessity, the insurance industry has always been subject to incremental use of technology and innovation. But the problem with incrementalism is synchronization. How can we get the most out of any insurance process when we are only enhancing or retrofitting components, not necessarily all simultaneously? While some improvement might be achieved, there is no real advancement of the business. Gaps and inconsistencies between enhanced solutions (or not) create bottlenecks, lost data, and operational inefficiencies.

But now…aligned innovation and simplification for insurance is possible. We now have the technology and tools to do what Tesla did, and then some! Next-gen architecture with native-cloud, headless, APIs, microservices, embedded analytics with business intelligence, AI/ML, real-time data access via data lakes, and Gen AI, provide insurance capabilities and innovation opportunities we may not have dreamt possible — allowing us to move away from incrementalism and into an area of rapid advancement for those who choose to embrace an entirely new next-gen intelligent solution platform for the business. The result…a major insurance technology shift is well underway.

Insurance technology trends point to necessary changes in the core.

Elevating insurers’ business operation with a next-gen, intelligent technology solution foundation built on a robust next-gen architecture is now a must-have to compete in today’s marketplace.

To meet today’s and tomorrow’s business demands, embracing next-gen architecture is essential. It is a paradigm that signifies a groundbreaking leap in software design, fueled by the pillars of modern innovation: cloud-native, API-first, microservices and containerization, headless, and embedded analytics.

Majesco’s annual Strategic Priorities surveys have found many trends that point to the necessity for change. They show the need for insurance processes aligned with real insurance technology innovation — something that goes beyond incremental steps by breaking new ground. To read the full thought-leadership report, be sure to download Realignment in Insurance: Strategic Priorities for Success.

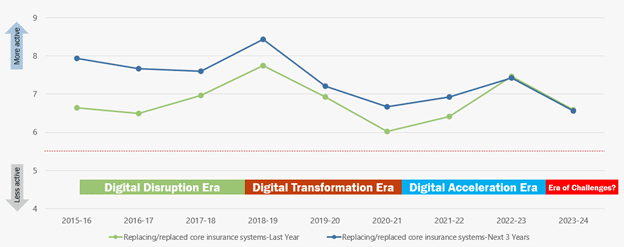

Literally at the core of the business and its processes are the Core Solutions – Policy, Billing, and Claims. As seen in Figure 1, replacing the legacy core previously peaked as we shifted to the Digital Transformation Era, but declining with a slight increase last year. This decline is surprising given that many insurers remain on legacy. More importantly, many decisions prior to the last 2-3 years were modern on-premise solutions, rather than native-cloud. Many insurers now face having modern legacy solutions that limit their business and use of technology advancements.

Figure 1: Insurers’ prior-year and planned strategic activities in replacing legacy core technology

The vanishing horizon of legacy replacement (Core systems)

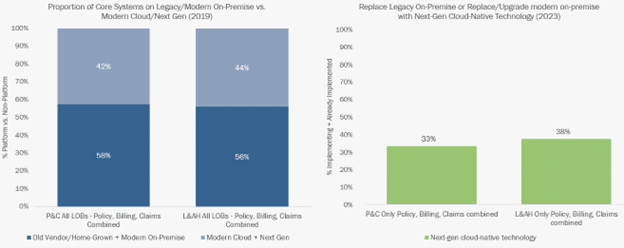

In our 2024 Core Systems Report[DG1] , we highlighted the 2019 Strategic Priorities survey results for both P&C and L&AH which had 56%-58% of their core systems as old vendor, home-grown or modern on-premise, as shown in Figure 2, with 42-44% in a modern, native-cloud platform.

This year’s results showed only 33% and 38% of P&C-Only and L&AH-Only carriers, respectively, said they were implementing or had implemented next-gen native-cloud technology, reflecting a slight decline as compared to 4 years ago.

Figure 2: Deployment of core systems in 2019 and activity levels in 2023

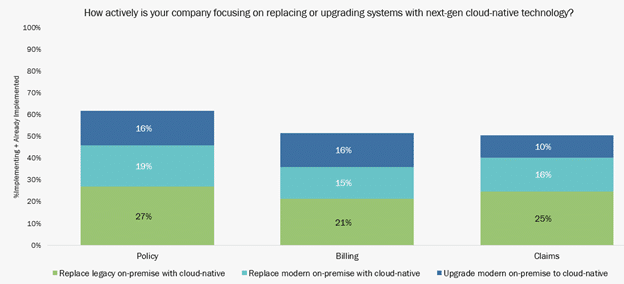

The lack of progress to next-gen native-cloud platforms is surprising and concerning. It highlights an increasing gap in the technology foundation needed to operate in an increasingly technology driven world. The good news is that many insurers indicate a strong focus on replacing legacy on-premise, modern on-premise, or upgrade to modern on-premise in Figure 3. But saying this and doing it are two different things as we saw in the difference over the last 4 years.

The pace of technology shifts requires insurers to diligently and quickly move to next-gen cloud-native solutions – minimizing customization of the past to enable true agility and adaptability for the business. This is a big mind-set and cultural change for insurers transforming. What got you here, will not get you to the future.

Figure 3: Insurers’ level of activity replacing and/or upgrading core systems

And the pressure to move to next-gen platforms is intensifying. As we noted in our Top 10 Trends for 2024 report, the cost and impact of legacy debt is catching up and pulling organizations down, from a cost, speed-to-market, operational, and talent perspective. The increase in industry retirements loss of institutional knowledge and skills, and a new generation of employees who will not work with legacy technology create a significant void of operational intelligence.

Even worse, these legacy systems are costly to the business given the high maintenance and operational costs, the inability to leverage existing and new data sources as well as emerging technologies like GenAI. The impact operationally can be seen in the business metrics and the lack of strong innovation scores from AM Best.

This is why moving to next-gen native cloud solutions must be a priority and investment for insurers rather than the traditional incrementalism approach.

An Insurer’s Ripe Opportunity

Today’s technology is now ready to address so many of our previous constraints, all at once. Each solution and capability are certainly ripe for change when looked at individually, but when looked at in light of a holistic move toward next-gen native-cloud systems that utilize AI and GenAI, their rationale goes far beyond where it did before.

What’s different today?

- Non-incremental, enterprise-wide improvement is now possible.

- Machine learning on data and its use by AI tools is far advanced from yesterday.

- Access to ALL your core data in real-time in a data lake house that can easily be augmented with other data is now a reality.

- Solution integrations, both internal and external connections, are easier and less costly with robust APIs.

- GenAI is rapidly redefining business processes to create a once in a generation opportunity to truly optimize the business with levels of productivity we have not seen in decades.

Now we can easily gather specific data on risk in order to rate, price, underwrite and reinsure.

Actuaries and underwriters have spent years honing their craft with great success — but always knowing that the best information was unavailable and undetected. Insurers were always fighting to find a balance between gathering longer forms of information (not a great practice for placing the business) and shortening the underwriting process in any manner possible.

In the face of rapidly changing risk factors, it is increasingly crucial to have capabilities for evaluating individual risks, the exposures in an entire portfolio, risk appetite, and ultimately, profitability. With the increased demand for products that offer more personalized underwriting based on specific customer factors, these technologies should be at the forefront of priority. And increasingly, data and analytics play a critical role in developing, pricing, rating, and underwriting traditional and new IoT-enabled products to Gig economy, on-demand, and telematic products.

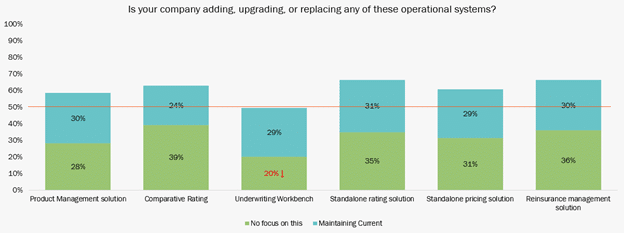

However, shockingly over 50% of insurers surveyed have no plans to add, upgrade, or replace these key solutions as shown in Figure 4.

Figure 4: Insurers’ level of activity in improving their product management, rating, underwriting, pricing, and reinsurance systems

Now we can use loss control technologies to truly predict and prevent.

Risk is growing and becoming more complex and frequent. The adage of “control what you can control” is now front and center for insurers with new risk management strategies for underwriting and customer service. Focusing priorities to better assess risk and prevent losses is now increasingly important.

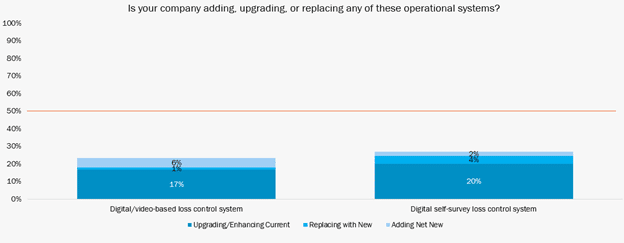

This is reflected in Figure 5 with 24% focused on upgrading, adding, or replacing digital video-based loss control systems and 26% doing the same with digital self-survey loss control systems. Each of these provides expanded capabilities for both loss control specialists but also for customers to do loss control themselves, helping insurers reach a broader portion of their portfolio.

Figure 5: Insurers’ level of activity in improving their loss control systems

No longer is loss control just for complex, high-risk scenarios, but also is increasingly being used across a broader swath of submissions for both personal and commercial lines of business by leveraging self-service loss control, AI, and advanced analytics, to drive broader portfolio profitability. With many insurers using in-house or outsourced adjusters and the cost associated with them, the ability to use digital tools that customers can use effectively allows insurers to manage a broader swath of risk more cost-effectively.

Now we can utilize insurance technologies and intelligence across the full spectrum of Distribution Management capabilities.

In an era where customer expectations are ever-evolving the insurance distribution landscape is changing. Traditional agent-based models, while still dominant, are making room for new channels from marketplaces to embedded, and more. Intensifying distribution demands are amplifying, requiring ease of digital onboarding and real-time compliance. Furthermore, advanced analytics is transforming how channel and distributor performance is tracked and optimized.

Distribution management solutions have often been managed within policy or home-grown solutions. With the changing distribution landscape distribution solutions are rising to the top. Generally, there are three prime areas of focus: onboarding and compliance, compensation management, and performance and relationship management. Some of these can be stand-alone and in other cases bundled into a single solution.

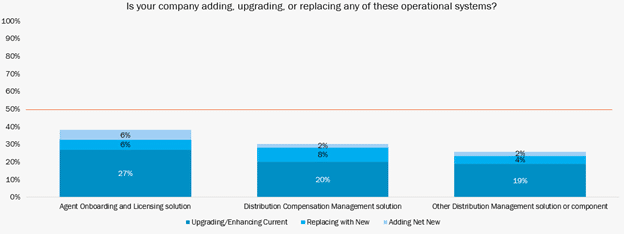

Unfortunately, insurers were more likely not focusing on these areas (33-45%) or maintaining their current (29%) as represented in Figure 6.

The result will put insurers at a disadvantage operationally and competitively as new channels continue to gain momentum and the existing agent channel continues to consolidate, creating a greater demand for ease of doing business and innovative compensation structures to compete.

Complexity and out-of-date insurance processes, particularly with distribution, impact the growth and profitability of almost every line of business.

Figure 6: Insurers’ level of activity in improving their distribution management systems

Now digital portals can provide truly excellent, seamless experiences.

Next-gen digital experiences that engage and excite agents and customers must take a holistic rather than transactional view. With digital demands outpacing the engagement capabilities of legacy portals, the industry has arrived at a time of reckoning – and the stakes are high.

To retain or gain trust and satisfaction, insurers now must consider all dimensions of the agent and customer experience rather than a “traditional portal” approach using next-gen technology including low code/no code, embedded data and analytics, APIs, and ecosystems to facilitate and communicate.

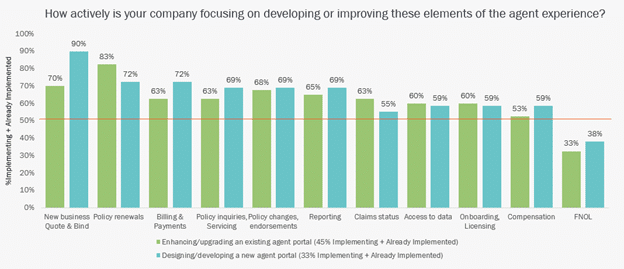

Encouragingly, the survey results in Figure 7 reflect that more insurers are creating new agent portals which aligns with the demands of “ease of doing business” and moving away from the first generation of portals.

Figure 7: Insurers’ level of activity in developing or improving the agent experience

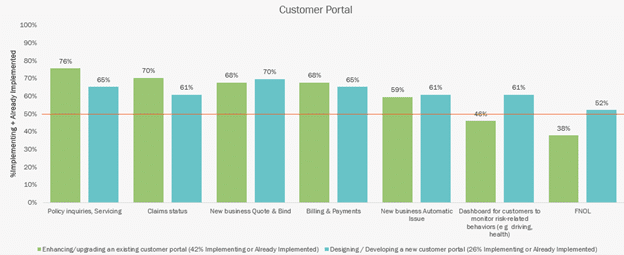

The same trend continues with customer portals, with more insurers focused on creating a new one versus enhancing/upgrading the existing one, as shown in Figure 8. The top areas reflect a shift to self-service of policies, FNOL, and billing/payments. In addition, the ability for customers to get a new business quote or new business automatic issue reflects the expansion of the B2C and B2B channels as insurers increasingly move into a multi-channel world.

Figure 8: Insurers’ level of activity in developing or improving the customer experience.

Agents and customers today expect an integrated, unified, and cohesive experience that services all their needs. Nothing less will do. The emergence of Digital Platforms that can create next-gen digital portals can become a reality. Insurers can orchestrate the complexities of technologies to deliver an experience tailored to the agent or customer rather than the technology that is servicing their needs.

GenAI is the new differentiator.

The advancement of these solutions to truly deliver on operational optimization, productivity and efficiency – something that has been elusive over the last 10-20 years of transformation – is now achievable with one technology — Gen AI. GenAI is both a “behind the scenes” process enhancer and an intelligent assistant and communicator that is re-inventing the insurance business end-to-end.

Majesco Copilot is an insurer’s GenAI partner, integrated into all Majesco-built solutions across the value chain. It enhances user experiences, streamlines operational processes, and drives improved productivity.

And we have embedded a broader data and analytics foundation across the entire solution[DG2] portfolio including a data lakehouse with access to all the solution data in real-time, business intelligence dashboards and personalized capabilities, embedded AI/ML models from Majesco and our partners, and GenAI in every screen and business process.

Is your organization ready for the boost that GenAI can bring to every part of the enterprise? Contact Majesco today and learn more about how Majesco Copilot is helping insurers to reinvent all of the parts of their business in synch, transforming today and revolutionizing the future of insurance.

The post Now Insurance Technology Solutions Can Rewrite the Story of Insurance appeared first on Majesco.