As long as there have been superheroes, there have been super suits. The suit’s original purpose was to distinguish the superhero from the average person on the street and to give them a brand of their own. When the superhero showed up, everyone knew, “Here’s our hero.” But even if the super suit began as a symbol, it quickly evolved (as writers grew more creative) into a tool with its own powers. Today’s superhero suits are clever and unique. Whether it is Iron Man’s armor, created by Tony Stark himself, or the Incredibles’ customized suits —stretchable and fireproof — their functionality is part of the superhero personality. Suit technology gives them more options on how to save the world.

The right insurance distribution management tools play a similar role. They not only provide super support to those who need them during important moments (the right capabilities to meet today’s complex insurance needs), but they also allow themselves to be customized to the user and their work. They can be fitted. This makes them incredibly valuable to insurers and distributors who utilize them day after day. The challenge is that many insurers don’t recognize the superpowers that distribution management solutions can wield in a competitive environment, playing a substantial role in insurance growth and market reach.

The state of an insurer’s distribution management channel options and capabilities can be a predictive indicator of an insurer’s growth in years to come.

Distribution management is foundational

In Majesco’s Thought Leadership report, Realignment in Insurance: Legacy Core Impact, we looked at varied strategic activities for correlations between particular efforts and an insurer’s growth potential. Looking at these activities helps insurers consider foundational priorities to build a future-ready insurance organization.

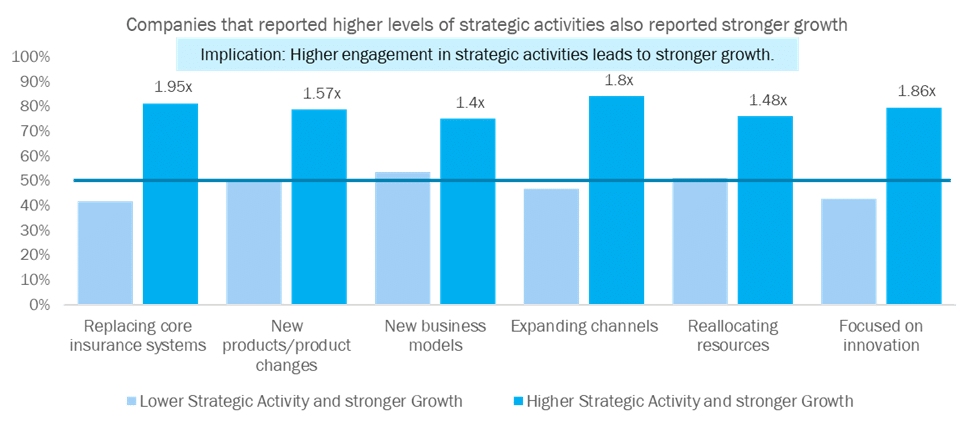

A new foundation requires the right investment across key areas and can make a substantial difference in growth, as reflected in Figure 1. Majesco’s research shows that insurers focused on and investing in replacing legacy core, creating new products, defining new business models, expanding channels, reallocating resources to the future business, and innovation initiatives report significantly higher growth than those who do not – from 1.4 to 1.95 times difference.

Insurers with a higher level of strategic activity around expanding channels, new products, and new business models are 1.4 to 1.8 times more likely to grow as those who have lower strategic activity, even if they have stronger growth in some areas.

Expanding channels and new business models are both impacted by an insurance company’s willingness to upgrade their distribution management systems.

Figure 1: Impacts of strategic activities on growth

Competing in today’s marketplace requires speed to market for new products, channels, and experiences. Replacement of legacy systems and building a next-gen distribution model can fast-forward insurers to a position of competitive leadership and growth.

Distribution Management today vs. yesterday. What’s different?

In an era where customer expectations on where and how to buy insurance are rapidly evolving, the distribution landscape is undergoing seismic shifts. Traditional agent-based models remain dominant but are making room for new channels from direct-to-customer to marketplaces, MGAs, affinity, embedded, and more.

At the same time, consolidation of agencies and brokers continues, creating a shift in power and expectation of “ease of doing business” with insurers. This spans from onboarding and compliance to performance and relationship management, compensation management, reporting, and digital portals for engagement. Regulatory complexities are amplifying, requiring adjustments and real-time compliance.

Out of necessity, insurers increasingly realize they require more robust capabilities and technology to effectively manage an ever-present complex environment. Unfortunately, many distribution operations are managed within legacy policy, spreadsheets, or home-grown solutions which struggle to keep up with the complexity and demands of a dynamic distribution market.

As a result, distribution management technology is rising in priority.

Generally, there are four areas of focus:

- Onboarding and compliance

- Compensation management

- Performance and relationship management

- Distributor portals

In Majesco’s strategic priorities survey, we asked about each of these components individually so that we could gain a priority view. Unfortunately, we found that well over 50-60% of insurers are not focusing on the first three: onboarding, compensation, and relationship management. Very few are replacing or adding a new system, potentially putting them at a disadvantage operationally and competitively in an increasingly competitive distribution landscape.

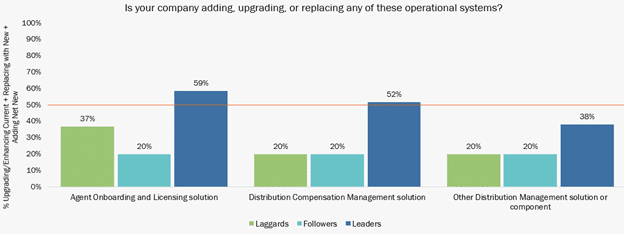

However, when analyzing the results based on Leaders versus Followers and Laggards, a different view emerges as shown in Figure 2. Leaders stand out dramatically – by nearly 2-3 times – in their focus on all these areas, creating a distinctive competitive advantage over Followers and Laggards. With the accelerated consolidation of the primary channel of agents, Leaders are positioned to attract more business given their greater ability to create “ease of doing business.”

Effectively managing and responding to the demands of agents, as well as the proliferation of new channels, is crucial to growth and market reach and cannot be accomplished using legacy methods and technology. Tapping into the potential of every channel requires different compensation programs and innovative, forward-looking measures that adapt to the distribution channel demands and differences.

Complexity and out-of-date insurance processes, particularly with distribution, impact the growth and profitability of almost every line of business.

Figure 2: Development of distribution management systems, by Leaders, Followers, Laggards

The fourth area of focus is digital experiences via an agent portal. With digital demands outpacing the engagement capabilities of many insurers, the industry has arrived at a time of reckoning – and the stakes are extremely high. Agents are demanding a better experience than what they have before. In insurance, that experience can be created with next-gen digital portals that have greater capabilities that help retain or regain trust and satisfaction.

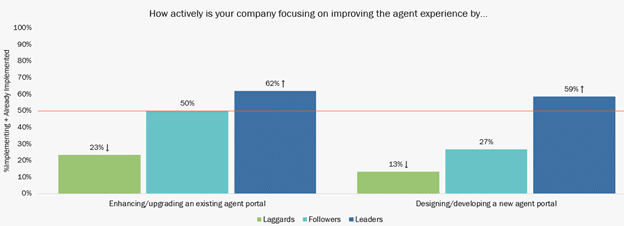

The survey results for agent portals in Figure 3 reflect once again the substantial difference between Leaders versus Followers and Laggards, particularly in developing a next-gen agent portal, where Leaders’ activity is 2 to 4.5 times greater. Leaders are aggressively moving away from the first-generation portals to create a differentiated experience and enable “ease of doing business.”

Insurers who help agents decrease the time and cost of their operations will win their loyalty and business.

Agents will gravitate to and place business with insurers who align with their expectations and needs of ease of doing business, particularly for placement and servicing of business. Insurers who can do so and help agents decrease the time and cost of their operations will win their loyalty and business.

Figure 3: Insurers’ level of activity in developing or improving the agent experience, by Leaders, Followers, Laggards

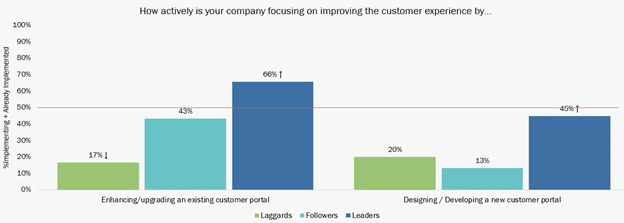

Interestingly enough, the same trend appears with customer portals, with Leaders outpacing Followers and Laggards in developing a new portal as shown in Figure 4, aligning with insureds increasing expectations.

Figure 4: Insurers’ level of activity in developing or improving the customer experience, by Leaders, Followers, Laggards

Insurers can orchestrate the complexities of technologies to deliver an experience tailored to the agent or customer rather than the technology that is servicing their needs.

Next-gen agent and customer digital portals offer significant value, including:

- Agents and insureds have access to real-time policy information and the ability to pay bills, submit claims, view claims status, and more.

- Customized processes adapt to personal preferences, creating the “personalized effect.”

- Mobile and browser access provides connections whenever and wherever it is needed.

Agents and customers today expect an integrated, unified, and cohesive digital experience that services all their needs and is “easy to use.” Next-gen digital portals are a reality today, one that Leaders are aggressively embracing to differentiate themselves in the market.

The Impact of GenAI and AI on Agent and Customer Portals

The super suit of distribution management is growing more powerful with the introduction of GenAI capabilities into distribution management solutions. In Majesco’s Distribution Management, users will find Majesco Copilot, a digital assistant that is driving operational efficiencies and productivity, allowing insurers to accelerate “ease of doing business” by optimizing distribution operations with 70-90% time savings for various transactions. More importantly, insurers have access to all their distribution operational data in real time to gain insights and manage their channels more effectively with embedded business intelligence dashboards.

Launching any new endeavor in insurance requires a thoughtful approach. What will be our ROI? How will this impact other areas of the organization? Insurance distribution management transformation checks many of the right boxes regarding organizational impact. It enhances and builds relationships, it makes work and life easier for people and it brings the organization back to the idea that the heart of great service is attention to detail, not only for customers but for those who support the business at every level of the distribution process. Distribution management will open insurers up to new channel possibilities, solidify relationships, and streamline vital business operations, inside and outside the organization.

For a look at additional tools for insurers and agents, be sure to watch Majesco’s webinar, Changing the Conversation and Competitive Landscape: Making it Easy for Agencies to do Business with Insurers to Grow their Books of Business.

The post The Next Gen Agent’s Super Suit: Insurance Distribution Management appeared first on Majesco.